Diligent

Last Updated:

Analyst Coverage: Alan Rodger

Diligent was founded as a technology company in 1994 and launched a successful software and services offering in 2003 that focused on corporate governance delivery. In parallel, long-established Canadian company ACL Analytics acquired the GRC SaaS solution vendor Rsam in 2019, and rebranded shortly afterwards to become Galvanize. Diligent acquired Galvanize in 2021, along with Steele (a provider of ethics and compliance solutions).

The company’s HQ is in New York City, and it has over 2,000 employees throughout its international office locations, which also include Canada, four European countries, South Africa, India, Singapore, and Australia. Its customer base includes 75% of the Fortune 500 and extends over 130 countries encompassing 26,000+ organisations in total. Its annual recurring revenues (ARR – totalling $582M in a recent FY) arise predominantly in the Americas (68%), with EMEA at 20%, and APAC at 12%. Diligent’s corporate governance solution set (‘Diligent Boards’) accounts for over 75% of ARR, with functionality relating to audit/risk the second-largest source (15%), with compliance and ethical/social governance (ESG) being lesser contributors.

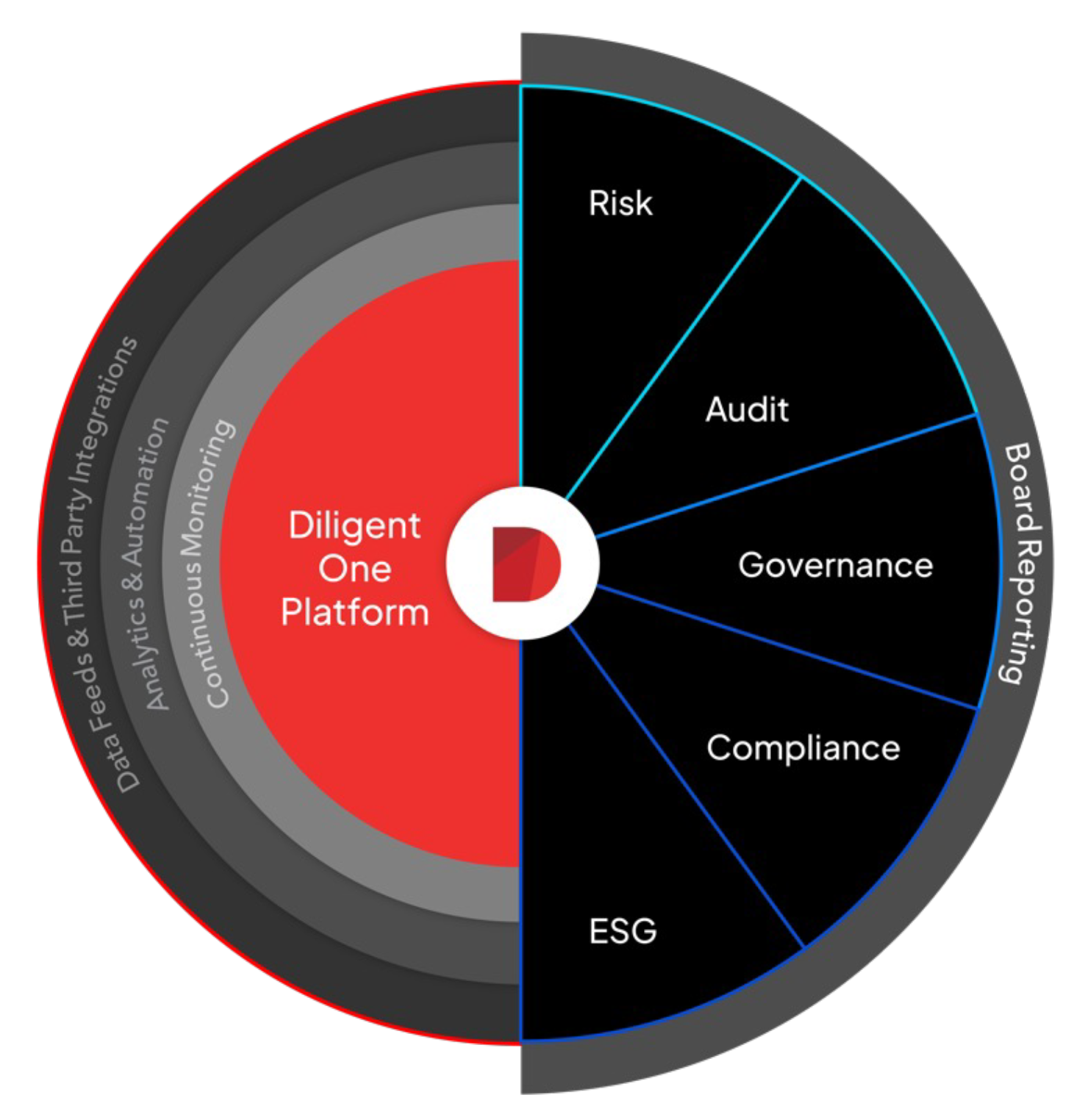

Over 90% of customers engage with Diligent’s corporate governance capabilities, greatly outnumbering the 2,000+ that use its other solutions. Of those customers using Boards, Diligent states that many do not use a broader GRC solution, thus making cross-selling opportunities for Diligent with the audit, risk, compliance, and ESG capabilities of its acquired portfolio. All the legacy solution sets are being standardised and integrated into a vertical range of GRC functions, branded as Diligent One and sharing a common platform.

Commentary

Coming soon.