MDM

Analyst Coverage:

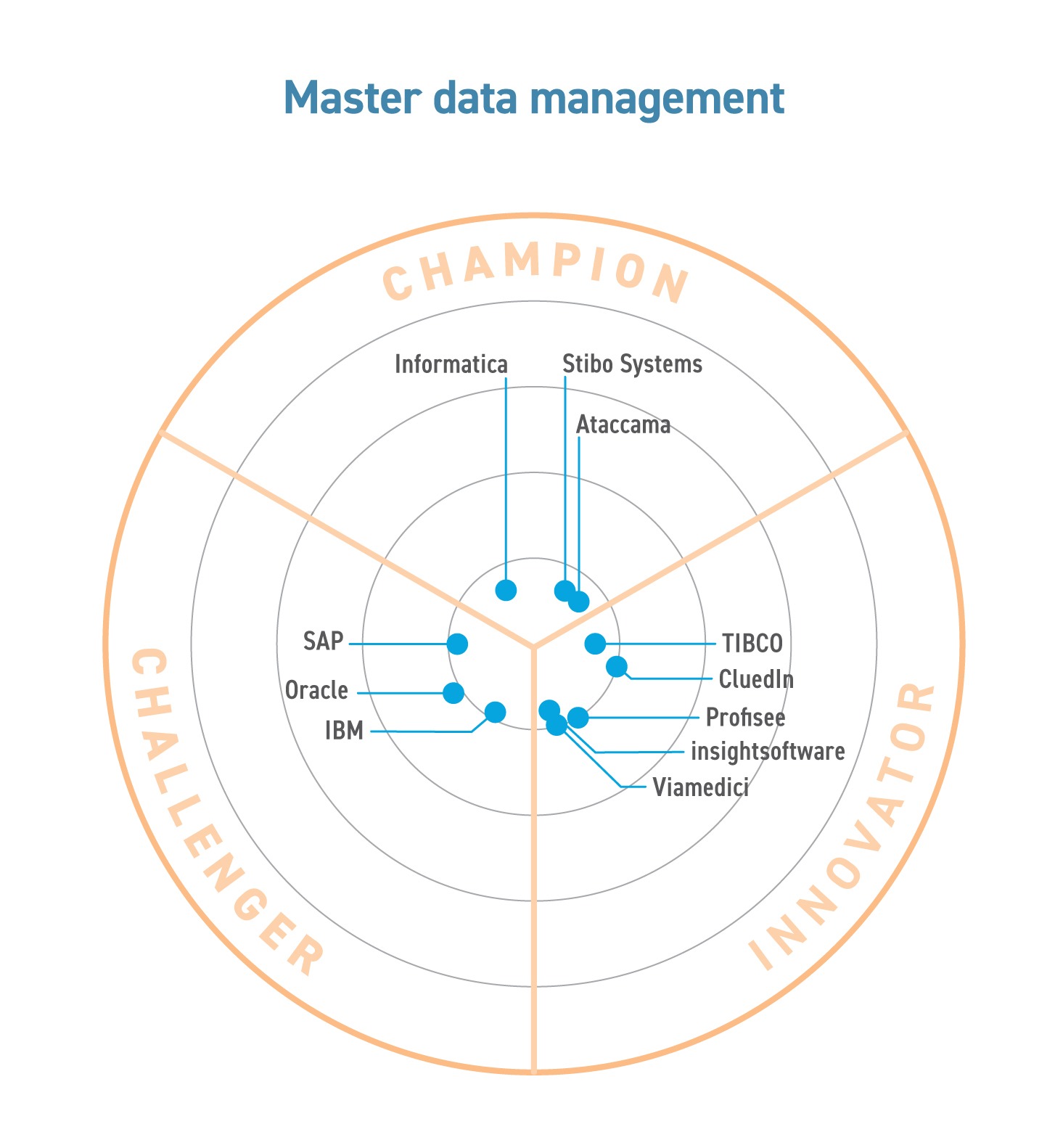

Master data is data that is shared between computer systems: typically data such as “customer”, “product”, “location”, “asset”, “contract”, etc. Large organisations have many systems which store such information and the management of multiple and competing definitions of this data is known as master data management (MDM). See “The full spectrum of MDM offerings”.

Master data management appeared in response to the difficulties that large enterprises have in handling their data across their many lines of business and subsidiaries. The average large company has at least 400 applications, just one of which is its ERP system (assuming that it just uses one of these, in itself a debatable assumption; many companies have multiple ERP instances or even multiple ERP vendors). Inevitably, some data is necessary to be in common across various of these systems, which themselves are a mix of in-house built and packages, of on-premises and cloud-based applications. In particular, data that gives context to business transactions, such as that about customers and products, tends to span many systems, meaning that each enterprise has many different and competing versions and classifications and definitions about customers, products, and other contextual data such as assets, locations, suppliers and more.

MDM applications need to be able to connect to a wide variety of source systems, both inside the enterprise and to third-party data, and bring this data together and consolidate it into a single, trusted source, eliminating duplicates. Multiple versions of master data held in source systems will need to be assessed, matched and merged into a single “golden record” that can be used by other downstream systems such as data warehouses and other analytic applications. In order to make decisions about which source systems are most trusted, the landscape of corporate data needs to be mapped and data ownership assigned. This has led to many MDM applications adding support for data stewardship and other governance activities, supporting the workflow around this. The quality of data in a master data hub is important, so MDM applications inevitably have some data quality functionality, either in-built or by embedding specialist technologies from other vendors.

Dealing with the intricacies of matching and merging data using explicit business rules can be time-consuming and problematic to scale for large amounts of data records, so machine learning is often employed to assist in this. Generating business descriptions to document data is also time-consuming, and some companies now use generative AI to save time with this. Given the overlap between data quality, MDM and data governance, it is not surprising to see the continuing erosion of the boundaries between these markets, with broader platforms that cover all these areas and more. However, specialist products, such as product information management tools, continue to thrive alongside these broader platforms, by providing specialist capabilities particular to certain data domains or industries. As enterprises continue to explore newer data architectures such as data fabric and data mesh, having a basis of reliable master data becomes increasingly important in order for such architectures to work well in practice.

The market has matured since its early days around 2004, with consolidation through acquisition by larger players. This acquisition continues to this day, with, for example, the purchase of Riversand by Syndigo and of Magnitude by insightsoftware. Most vendors nowadays offer a broader platform than simply an MDM hub, usually with merge/matching of records and other data quality capabilities built-in along with support for data governance. Some vendors also provide data integration and transformation capabilities as well.

The MDM market continues to show healthy revenue growth. Estimates vary, but the MDM market is expected to grow around 16% in 2025, compared to around 8% or so in the overall enterprise sof

MDM is a well-established industry that continues to grow at roughly twice the rate of the general enterprise software industry. Given that enterprises have an increasing spectrum of data to manage, from traditional transaction processing systems, to externally provided data, through to eCommerce data and more, MDM vendors are having to adapt to that changing landscape. Artificial intelligence is being embraced by the industry, from machine learning for the automated merge/matching of records, through to providing natural language interfaces for business users to query their master data. This trend is likely to continue as AI continues to be embraced by large enterprises. Although MDM is a maturing industry compared to its early days two decades ago, there continue to be opportunities for innovation, of which AI is just one example.

Related Blog

Related Research

Related Companies

Connect with Us

Ready to Get Started

Learn how Bloor Research can support your organization’s journey toward a smarter, more secure future."

Connect with us Join Our Community